Building Financial Literacy That Matters

We've spent years watching people make the same financial mistakes because no one taught them the fundamentals. dremolavixa exists to change that reality.

Why We Started dremolavixa

Back in 2018, I was consulting for small businesses across Sydney and kept seeing the same patterns. Smart business owners making decisions based on gut feelings rather than financial data. Families avoiding investment conversations because they felt overwhelmed by jargon.

The problem wasn't intelligence or motivation. People simply hadn't been taught how to read financial statements, understand market cycles, or plan for long-term wealth building. Traditional education skipped these practical skills entirely.

dremolavixa started as weekend workshops in community centers. We focused on breaking down complex financial concepts into understandable steps. What began as helping 12 people read their first annual report has grown into comprehensive programs that serve hundreds of learners annually.

What Drives Our Approach

Financial education should be accessible, practical, and honest about both opportunities and risks. These principles guide every program we develop.

Real-World Application

Every concept we teach connects directly to decisions you'll face. We use actual case studies from Australian businesses and personal finance situations, not theoretical examples from textbooks.

Honest About Limitations

We don't promise overnight success or guaranteed returns. Financial literacy is a skill that develops over years of practice. Our job is providing solid foundations and ongoing support as you build experience.

Practical Skills Focus

You'll learn to analyze cash flow statements, evaluate investment opportunities, and understand economic indicators that affect your decisions. These aren't academic exercises – they're tools you'll use regularly.

Ongoing Learning Support

Financial markets and regulations change constantly. Our programs include regular updates on new developments and continued access to resources as your understanding deepens.

Leadership & Expertise

Our programs are led by professionals who've worked in corporate finance, investment analysis, and business consulting across Australia's major markets.

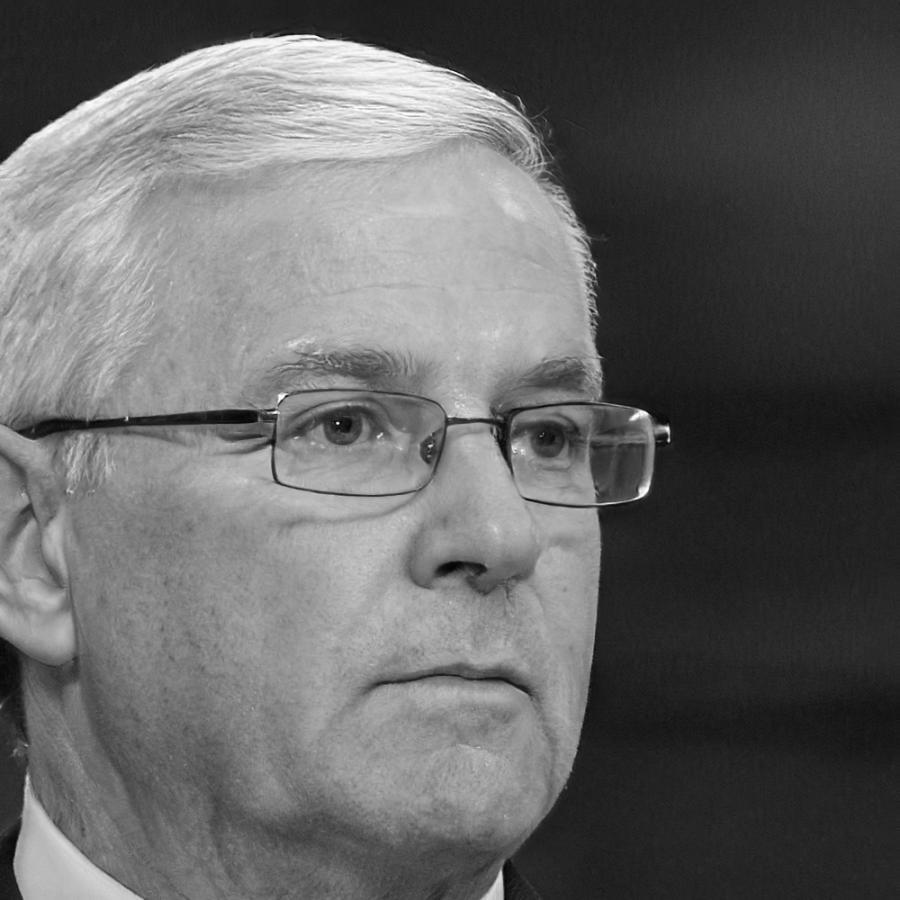

Kieran Thornfield

Lead Financial Educator & Program Director

Kieran spent eight years as a senior financial analyst with Westpac before transitioning to education in 2019. His background includes corporate lending analysis, small business advisory services, and investment portfolio management.

He holds a Master of Applied Finance from Macquarie University and maintains ongoing professional development through the Financial Planning Association of Australia. Kieran has personally guided over 400 individuals through our comprehensive financial literacy programs.

His teaching approach focuses on breaking down complex financial concepts into practical steps that learners can immediately apply to their personal and business situations.

How We Structure Learning

Our methodology combines theoretical knowledge with hands-on analysis of real financial scenarios. Each program builds skills progressively while maintaining focus on practical application.

Case Study Analysis

Every session includes analysis of actual business financial statements and investment scenarios from Australian companies. You'll practice interpreting data that reflects real market conditions and business challenges.

Progressive Skill Building

We start with fundamental concepts like cash flow analysis and gradually introduce more advanced topics including portfolio theory and risk assessment. Each module builds on previous learning while introducing new practical tools.

Industry Context

All examples and exercises reflect current Australian financial regulations and market conditions. You'll understand how concepts apply specifically within our regulatory environment and economic landscape.

Practical Implementation

Each program includes guided practice sessions where you apply new concepts to your own financial situation or business context. This ensures learning translates directly into improved decision-making capabilities.